The Inflation Choke: How to Stop Passing 62% Cost Spikes to Customers (Without Eating Them)

Your costs jumped 18%, but you only raised prices 12%. That 6% gap is killing you. Here's the third option nobody's talking about.

62% of small business owners say inflation is their biggest source of stress, according to data from February 2025. Not cash flow. Not competition. Inflation.

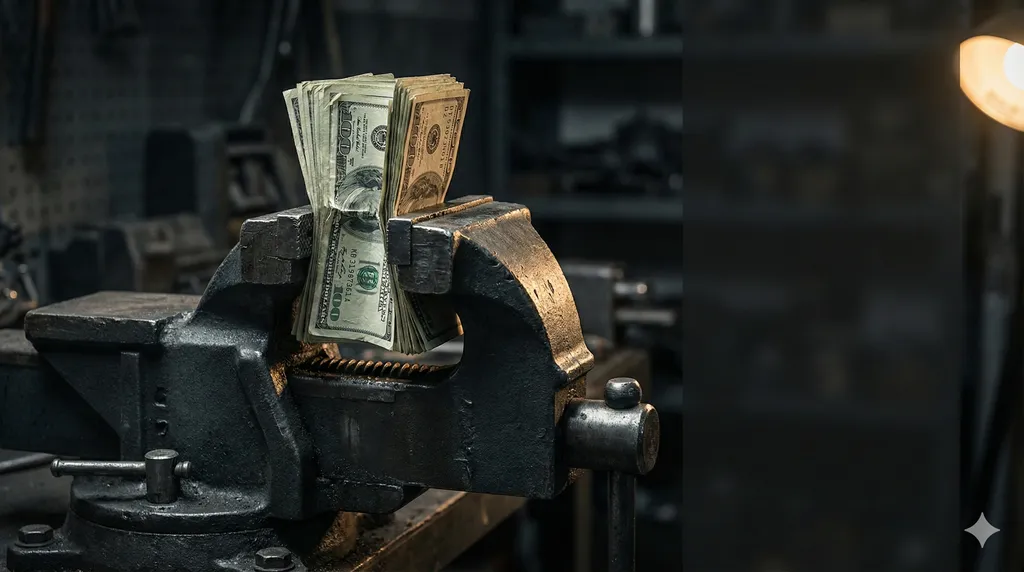

And here's why: You're caught in a vise that's tightening by the quarter.

Recent data from November 2025 shows business owners report their costs increased an average of 18%. They raised prices by 12%. That 6-point gap? That's your margin, disappearing in real-time.

You've got two choices, and both are terrible. Raise prices and lose customers. Or absorb costs and watch your margin evaporate until you're working for free.

But there's a third option. And the businesses using it right now are pulling ahead while everyone else bleeds.

The Math That's Killing You

Let me show you what's really happening.

When you raise prices by just 1%, your annual customer churn jumps from 14% to 21%—that's a 50% increase in defections, according to Federal Reserve Bank of Richmond research widely cited in 2025 pricing strategy discussions.

Think about that. You need the price increase to protect margins, but the price increase itself drives away the customers who were paying those margins.

And it gets worse. Bank of America's November 2025 report found that 31% of businesses that raised prices saw sales decrease. You didn't just lose some customers—you lost revenue.

One Massachusetts manufacturer told CNN in November 2025: "Everyone is hunkering down and building up cash. It's never been this bad."

When experienced business owners say it's never been this bad—through multiple recessions—you know something fundamental has broken.

Why "Just Raise Prices" Is Business Suicide Right Now

Your customers are done.

Recent data from 2025 shows half of all shoppers now visit two different stores each month just to compare prices. A quarter visit three or more. They're putting in the work to find cheaper alternatives.

And they're not shy about telling you why they left. Check the reviews. "Prices that don't match the quality" shows up again and again in 2025 restaurant feedback. Customers feel they're paying more and getting less.

Here's the real problem: The New York Federal Reserve found in June 2025 that businesses are split almost evenly—32% passing costs to customers, 30% absorbing them. There's no consensus because there's no good answer.

The KeyBank Small Business Survey from 2025 found one in four business owners describe their current status as "survival mode." Not growth mode. Survival.

That's not hyperbole. That's the math finally catching up.

The Third Way: Per-Transaction Cost Surgery

Stop thinking about raising prices or cutting costs. Start thinking about cost per transaction.

Here's what that means: A bottom-quartile business spends $12.44 to process each invoice. An automated business spends $4.98. That's a 60% reduction per transaction, according to 2025 invoice processing automation studies.

Process 1,000 invoices monthly? That's $89,520 in annual savings. Zero price increases. Zero customers lost.

The average ROI on automation? 240%, recovered within six to nine months, according to recent 2025 Symtrax research.

And I'm not talking about manufacturing robots. I'm talking about the repetitive stuff eating your time and money right now:

Customer service. Data entry. Appointment reminders. Follow-up sequences. Invoice processing.

Real Businesses, Real Numbers (From 2025)

Klarna—the fintech company—deployed an AI chatbot that now does the work of 700 full-time customer service agents. The profit improvement? $40 million.

A small dental practice implemented automated appointment reminders. No-shows dropped 67% within three months. Each no-show was lost revenue they couldn't recover. Now they're capturing it.

The Second City entertainment company was paying $40,000 annually for accounts payable processing. They switched to modern automation and cut that cost by over 80% while gaining more functionality.

These aren't massive corporations with unlimited budgets. These are businesses like yours, facing the same pressures, who found a different way through.

What This Actually Means for You

Pull out your calculator.

Take your monthly transaction volume—calls handled, invoices processed, appointments scheduled, customer service interactions, whatever applies to your business.

Multiply by your current cost per transaction. Then multiply by 0.40 (a conservative 60% reduction).

That number? That's money you're leaving on the table every single month while you agonize over whether to raise prices another 2%.

Companies implementing AI-driven cost optimization in 2025 are achieving operational savings of 35-45% within the first two years, according to Gartner. That's not margin protection. That's margin expansion.

And here's the competitive advantage nobody's talking about: While your competitors raise prices and lose customers, you maintain pricing and improve service. You're the business customers compare everyone else to.

The Bottom Line

The 62% of business owners stressed about inflation? They're stuck in binary thinking: raise prices or eat costs.

The ones pulling ahead in December 2025 found option three: systematically reduce the cost of each transaction until your margins work at current prices.

Your costs went up 18%. If you can cut operational costs by 20-30% through automation, you're not just protecting margins—you're improving them. Without touching your prices. Without losing a single customer.

That's not theory. That's what the numbers show is happening right now for businesses willing to look at per-transaction economics instead of just top-line pricing.

The inflation choke doesn't loosen until you stop letting every transaction cost more than it should.

Ready to Never Miss Another Call?

Start your free trial with Julya AI and turn every ring into revenue.

Get Started for FreeRelated Articles

The 3 AM Test: How to Book Appointments While You Sleep (Without Waking Up)

40% of appointments happen after hours. Miss those calls and you're leaving $126K on the table. Here's how to capture every lead-even at 3 AM.

The Warm Handoff: Why AI Should Brief Your Staff, Not Replace Them

Smart businesses use AI to multiply human effectiveness, not eliminate it. Here's why the warm handoff beats full automation every time.

From Chaos to Calendar: Stopping the Double-Booked Disaster Before It Happens

Double-booking costs businesses $26,000 yearly. Here's how smart scheduling prevents conflicts, saves revenue, and stops customers from rage-quitting.